Blog

Top 3 Regrets of Retired Farmers

https://www.pinionglobal.com/top-3-regrets-of-retired-farmers/ #Farmers #Retirement #SuccessionPlanning #IHT #FutureGeneration In life, there’s an easy way or a hard way to do most things. There are countless examples of this in agriculture, and farmers are resilient as the result of facing challenges and overcoming unexpected obstacles the only way they can: the hard way.…

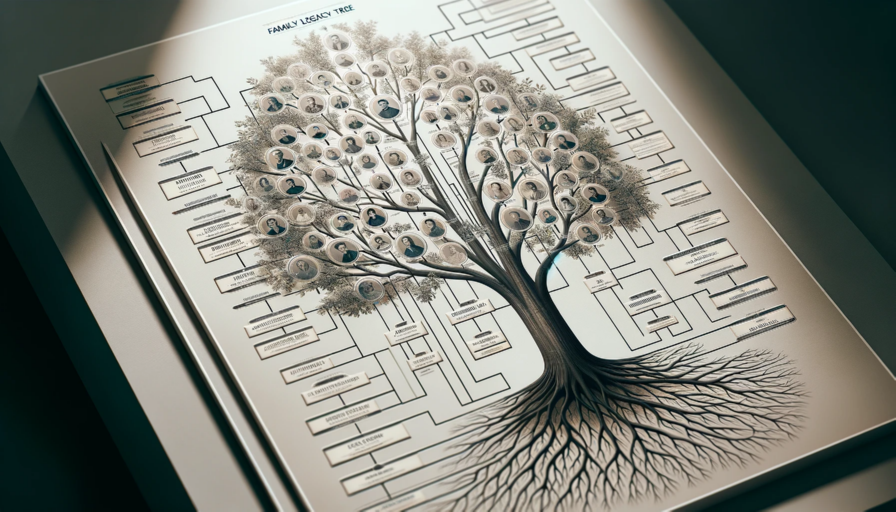

The Importance Of Farm Succession Planning

https://www.farmdiversity.co.uk/advice/importance-farm-succession-planning #farmSuccessionPlanning #IHT #farmers #SuccessionPlanning #InheritanceTax #FutureGeneration The agricultural industry is incredibly complex, and farming is a time-consuming and demanding role. With so much to do to ensure the farm business runs smoothly, many farmers tend to put “planning for the future” on the back burner. Passing a farm from…

The Merits of a Professionally Drafted Will: Protecting Your Legacy and Loved Ones

https://theplanningbee.co.uk/the-merits-of-a-professionally-drafted-will-protecting-your-legacy-and-loved-ones/ #guide #willwriting #estateplanning #ProfessionalWill #LovedOnes Planning for the future is one of the most responsible steps you can take, yet many overlook the importance of having a professionally drafted Will. At The Planning Bee, we emphasize the critical role a Will plays in safeguarding your assets and ensuring your…

The Ultimate Guide to Preparing for Your Estate Plan

https://www.trustribbon.com/blog/the-ultimate-guide-to-preparing-for-your-estate-plan #guide #willwriting #estateplanning #lastwill Preparing for your estate plan may seem overwhelming, but it's an essential step in securing your family's future and ensuring your legacy is preserved according to your wishes. Planning for a scenario where you're no longer around or unable to make decisions can be a…

Odd Celebrity Will Requests

https://redwoodfinancial.co.uk/odd-celebrity-will-requests/ #Wills #willwriting #estateplanning Let’s face it. We’re all a bit nosey and like to look at celebrity Wills. Here is a list of some of the strange requests some of the most famous people have included in their Last Will and Testament. 1. Janis Joplin Recording artist and songwriter…

Why make a Will?

https://www.parfittcresswell.com/wills-probate/wills-probate-trusts/why-make-a-will #IHT #inheritancetax #estateplanning #HMRC Making a Will Making a Will is one of the most fundamental aspects of estate planning and the only legal way to guarantee that your wishes will be fulfilled when you’re gone. Making a Will is incredibly important yet over half of UK adults don’t have…

Plan Ahead – How To Reduce Inheritance Tax For Your Loved Ones

https://phillips-law.co.uk/insights/phillips-law-urges-local-families-to-plan-ahead-to-reduce-their-inheritance-tax-bill/#:~:text=22%20July%202024,out%20of%20what%20they%20inherit. #IHT #inheritancetax #estateplanning #HMRC The latest figures from HMRC show that Inheritance Tax receipts have risen by 7.2% since last year. By taking advantage of available tax reliefs and planning carefully, families can make sure their loved ones pay the smallest tax bill possible and get the most out of…

How to Avoid Inheritance Tax Under the New 2024 Rules

https://inheritance-tax.co.uk/avoid-inheritance-tax-under-the-new-2024-rules/ #IHT #inheritancetax #2024 #IHTrules The October 2024 changes to inheritance tax (IHT) rules in the UK have brought new complexities to estate planning. For families with substantial assets, such as pensions and farms, understanding these updates and adjusting strategies accordingly is essential to minimising tax burdens on beneficiaries. This blog…

Understanding the New UK Inheritance Tax (IHT) Rules for Pensions

https://inheritance-tax.co.uk/understanding-the-new-uk-iht-rules/ #IHT #inheritance #tax In the Autumn Budget 2024, Chancellor Rachel Reeves introduced significant changes to Inheritance Tax (IHT) on pensions, impacting UK-registered pension schemes and Qualifying Non-UK Pension Schemes (QNUPS). Starting April 6, 2027, these reforms aim to bring pensions in line with other inheritance assets, eliminating the tax advantage…

Navigating the Complexities of UK Inheritance Tax on Trusts and Lifetime Gifts

https://www.soteriatrusts.com/insights/navigating-the-complexities-of-uk-inheritance-tax-on-trusts-and-lifetime-gifts/ #UKTax #trusts #gifts Inheritance tax (IHT) in the UK is a critical consideration for anyone involved in estate planning. The complexities surrounding IHT on trusts and lifetime gifts can be daunting, but understanding these elements is essential for tax efficient financial planning. This blog post aims to clarify the…

Inheritance Tax Across Europe A Comparative Overview

https://www.soteriatrusts.com/insights/understanding-inheritance-tax-across-europe-a-comparative-overview/ #IHT #tax #europe Inheritance tax(IHT), a levy on the assets of the deceased before they pass to heirs, varies greatly across Europe. This tax can impact the amount that beneficiaries ultimately receive, and the rules and rates differ significantly from one country to another. In this article, we’ll explore…

Innovative Tax Planning Strategies to Minimize Inheritance Tax Liabilities

https://www.soteriatrusts.com/insights/innovative-tax-planning-strategies-to-minimize-inheritance-tax-liabilities/ #IHT #tax #taxliabilities Inheritance tax (IHT) in the UK can significantly impact the wealth passed on to beneficiaries, with estates over the nil-rate band facing a hefty 40% tax. However, with careful planning and strategic financial decisions, it’s possible to minimize these liabilities, ensuring more of your assets are…

Impact of Economic Conditions on UK Inheritance Tax Receipts

https://www.soteriatrusts.com/insights/impact-of-economic-conditions-on-uk-inheritance-tax-receipts/ #IHT #Inheritance #InheritanceTax The impact of the economy on inheritance tax receipts in the UK has become a topic of significant interest. With inheritance tax (IHT) often perceived as a barometer of economic conditions, understanding how these forecasts influence IHT receipts can inform both policy and personal financial planning.…

Unlock Your Estate’s Potential IHT Planning Ahead of the October Budget!

https://www.wardwilliams.co.uk/blog/posts/2024/august/unlock-your-estate-s-potential-iht-planning-ahead-of-the-october-budget/ #IHT #Estate #OctoberBudget Unlock Your Estate’s Potential: IHT Planning Ahead of the October Budget! The Expertise You Can’t Afford to Ignore As the leaves begin to turn and autumn approaches, UK residents should turn their attention to an important financial matter: Inheritance Tax (IHT) planning. With the Chancellor's Budget…

Why You Should Trust Professionals on Estate Planning

https://www.sallenlawfirm.com/blogs/2024/october/why-you-should-trust-professionals-on-estate-pla/ #IHT #ProfessionalEstatePlanning #EstatePlanning Estate planning can be tricky. We all know it's essential, but when faced with the realities of death and taxes, it’s easy to fall into the trap of thinking we can handle it ourselves. After all, who knows your assets and wishes better than you do?…

How much does Inheritance Tax Planning cost?

https://www.soteriatrusts.com/insights/iht-planning-cost/ #IHT #Inheritance #InheritanceTax Inheritance tax (IHT) planning is essential for anyone with assets in the UK, especially if you’re a property investor or an expat with UK ties. Preparing for IHT can help you manage your financial legacy and ensure your beneficiaries receive their due without an excessively taxing…

Understanding the Role of the Family Trustee

https://www.soteriatrusts.com/insights/role-family-trustee/ #Wills #FamilyTrustee #Trustee In the labyrinth of the high-net-worth family universe, the trustee stands as a cryptic figure, a guardian of the family’s legacy. They are tasked with wielding significant power and responsibility over the wealth and welfare of those within the trust. But what does this role entail,…

Spring Budget 2024: Simplifying the UK’s Tax Reforms for Non-Domiciled Residents

https://www.soteriatrusts.com/insights/spring-2024-tax-reform-non-domicile/ #TaxReforms #SpringBudget #UKTax The UK government is committed to creating a tax system that not only draws in global talent and investment but also spurs economic expansion. At the heart of its philosophy lies the conviction that individuals with more substantial financial means ought to bear a larger share…

Maximising Gifting Strategies for Inheritance Tax Efficiency

https://www.soteriatrusts.com/insights/gifting-strategies-iht/ #IHT #InheritanceTax #Tax Navigating the complexities of inheritance tax (IHT) can be a daunting task for individuals – especially those from affluent families with significant assets. Gifting, when done correctly, provides a way to reduce the tax liabilities of both the gifter and the recipient. By harnessing the various…

How to own a property in the UK?

https://www.soteriatrusts.com/insights/how-to-own-uk-property/ #Property #HomeOwner #UKProperty Owning property in the United Kingdom (UK) can be an enticing prospect for many, whether as a home or an investment. However, navigating the process can seem daunting, especially if you’re unfamiliar with the UK’s property market and taxation system. This article will shed light on…

How Difficult is it to do Probate Yourself?

https://www.soteriatrusts.com/insights/how-difficult-is-it-to-do-probate-yourself/ #ProbateLaw #legal #Probate Probate is the administrative process that we all, well… our estates, have to go through once we have passed away. While it is possible for your executors or family members to handle probate on your behalf, the complexity of the process can make it quite challenging.…

UK Property Taxes – A simple Guide to Investing in the UK

https://www.soteriatrusts.com/insights/guide-uk-property-taxes/ #PropertyTaxes #Tax #UKTax #Property Navigating UK Property Taxes: A Definitive Guide for International Investors For international investors, the pursuit of property in the UK can be both alluring and complex. The UK housing market has long been a beacon of stability, and its capital city, London, has historically been…

The Future of Inheritance Tax in the UK

https://www.soteriatrusts.com/insights/the-future-of-inheritance-tax-in-the-uk/ #IHT #InheritanceTax #UKTax The landscape of inheritance tax (IHT) in the UK is poised for potential changes influenced by economic conditions, political shifts, and evolving societal norms. Understanding these dynamics is crucial for individuals involved in estate planning, as they strive to optimize their financial strategies in response to…

The Role of QNUPS in Estate Planning for UK Residents

https://www.soteriatrusts.com/insights/the-role-of-qnups-in-estate-planning-for-uk-residents/ #EstatePlanning #qnups #LegacyPlanning Estate planning is a critical aspect of financial management, particularly for those looking to secure their wealth for future generations. In the UK, individuals are constantly seeking ways to optimize their estate plans to minimize tax liabilities and maximize asset protection. One of the tools gaining…

Impact of Economic Conditions on UK Inheritance Tax Receipts

https://www.soteriatrusts.com/insights/impact-of-economic-conditions-on-uk-inheritance-tax-receipts/ #IHT #Tax #InheritanceTax The impact of the economy on inheritance tax receipts in the UK has become a topic of significant interest. With inheritance tax (IHT) often perceived as a barometer of economic conditions, understanding how these forecasts influence IHT receipts can inform both policy and personal financial planning.…

10 Top Questions About… Family Business Succession Planning

https://www.pantheraestateplanning.co.uk/blog/10-top-questions-about-family-business-succession-planning #SucessionPlanning #FamilyBusiness #Wills Your top questions about family business succession - and how to include it in your estate planning. 1. What is family business succession planning? In terms of the business, it's pretty much what is says - working out who would take over your family business whether…

Leaving a legacy or looking out for no1? Wills, Trusts and long-term care planning

https://www.pantheraestateplanning.co.uk/blog/trusts-long-term-care-planning #willing #trusts #CarePlanning The new Scottish Widows Retirement Report for 2024 has just been released. For 20 years this annual report has surveyed people to understand “Their hopes and aspirations (for) retirement, to understand the plans that they have made, and to also understand their actual expectations.” I've read…

10 Big Estate Planning Mistakes of the Rich & Famous

https://www.thinkadvisor.com/2014/03/13/10-big-estate-planning-mistakes-of-the-rich-famou/ #willing #willwriting Estate planning can be tricky, and for celebrities with mega assets, the stakes for heirs are enormous. Try this free 10 minute online course today. Includes certificate, £50 voucher. It seems that mistakes are often made in writing wills and when they are, the tabloids have a…

10 Interesting Facts About Wills You May Not Know

https://buzzfinancial.co.uk/facts-about-wills/ #willing #willwriting A will is an important document and one that should be taken very seriously. It is your last will and testament and ensures that your wishes are carried out, and that your loved ones are taken care of, after you have gone. We take a look at…

Estate Planning: 16 Things to Do Before You Die

https://www.investopedia.com/articles/retirement/10/estate-planning-checklist.asp #willing #willwriting Complete this checklist to get your affairs in order When Aretha Franklin died intestate—without a legal will—in 2018, she joined a surprisingly long list of prominent people, including Prince, who did the same.By not preparing an estate plan, she complicated the task of settling her affairs for…

13 IMPORTANT QUESTIONS TO ASK WHEN CREATING YOUR ESTATE PLAN

https://internationalservices.hsbc.com/manage-wealth-abroad/13-important-questions-to-ask-when-creating-your-estate-plan/ #willing #willwriting If you got sick, or were unable to make important decisions, is there someone you trust to handle your affairs? Would your business continue to run smoothly and your family be provided for? Estate planning is about finding the best answers to these difficult questions. Let's take…

12 FAMOUS PEOPLE WHO DIDN’T LEAVE A WILL, INCLUDING PICASSO AND PRINCE

https://www.businessinsider.com/12-famous-people-who-died-without-will-picasso-prince-2023-8 #willing #willwriting A Michigan jury ruled in July that a document written by Aretha Franklin before she died was a valid will. She is among several celebrities who have died without a will, including Billie Holiday and Kurt Cobain. Without a will, celebrity estates often become embattled in lawsuits,…

12 OF THE MOST UNUSUAL CELEBRITY WILLS

https://uk.finance.yahoo.com/news/12-most-unusual-celebrity-wills-104700483.html #willing #willwriting Surprising and explosive legacies Most wills are pretty straightforward – but some people aren't content with simply leaving their money to their nearest and dearest when they die. From Marilyn Monroe to a comedian who made a romantic gesture from beyond the grave, read on to discover…

WILLS OF FAMOUS PEOPLE

https://issuu.com/sanantoniobar/docs/sal-marapr21-digital/s/11930484 #willing #willwriting You can learn a lot about a person by reading his or her last will and testament. Many famous people left a written will, and some of those wills shaped the course of history. Often, those who ruled great empires used their wills as a final act…

WEIRD AND WONDERFUL CELEBRITY WILLS

https://www.unbiased.co.uk/news/financial-planning/weird-and-wonderful-celebrity-wills #willing #willwriting Today we’re taking a peek at the bizarre and barmy wills of the rich and famous. We’ve long been fascinated with the rich and famous: their relationships, their style and their wallets. But what do they leave behind after the lights have gone down? That’s magic. Harry…

10 OF THE STRANGEST WILLS OF ALL TIME

https://www.theguardian.com/money/2015/aug/25/10-strangest-wills-finances-death #WillWriting #Legacy #EstatePlanning Leaving instructions for what should happen to your finances after your death is a serious matter – but for some the temptation to cause mischief or raise a smile from beyond the grave is too much to resist In the UK we are not very good…

WHAT HAPPENS TO A DECEASED PERSON’S MONEY AND POSSESSIONS?

https://www.citizensinformation.ie/en/death/the-deceaseds-estate/what-happens-the-deceaseds-estate/ #willing #willwriting Introduction When a person dies, their property passes to their personal representative. The personal representative then distributes the deceased's person’s assets (money, possessions and property) in accordance with the will - if there is one - or the laws of intestacy if there is no will. These…

WILL WRITING – A STEP BY STEP GUIDE

https://www.soteriatrusts.com/insights/will-writing/ #willwriting #willtowin Writing a will is an important part of ensuring that your assets and belongings are properly distributed after passing. It can be a daunting and overwhelming task if you don’t have all the necessary information—but it’s also one of the most crucial steps for ensuring that your…

HOW CAN DIY WILLS LEAD TO INHERITANCE DISPUTES?

https://www.thegazette.co.uk/all-notices/content/103355 #knowyourwill #willwriting The number of inheritance disputes reaching the High Court is rising dramatically, driven in part by increases in property prices which make estates worth more than ever; life expectancy is allowing wills to be made and amended later on in life, and family structures are creating more…

10 MYTHS ABOUT MAKING A WILL

https://www.corning-cc.edu/foundation/baron-bulletin-stories/myths-about-wills.php #willwriting #knowyourwill When you spend a lifetime working and earning for your future, you need to care for the way those assets are managed and shared with your loved ones. Most adults do not even have a basic plan in place which leaves all that you have worked for…

PROBATE EXPERTS WARN AGAINST ONLINE WILLS

https://www.lawgazette.co.uk/news/probate-experts-warn-against-online-wills/5110251.article #willtowin #knowyourwill The growing popularity of online will writing could lead to a ‘surge’ in contested probate cases down the line, probate experts have warned. Funeral Solution Expert, a research and consultancy firm, analysed 26 online will writers and found that consumers are often mistaken as to whether their…

STEP WARNS PUBLIC AGAINST ‘COWBOY’ WILL WRITERS

https://todayswillsandprobate.co.uk/step-warns-public-against-cowboy-will-writers/ #willtowin #knowyourwill The public has been warned of the dangers of “cowboy” will writers by the Society of Trust and Estate Practitioners (STEP) following the publication of its new report on the unregulated will writing sector. Create Your Will Online Today According to STEP, “dishonest, unqualified, and incompetent” will…

ESTATE PLANNING: WHY YOU SHOULD BEGIN NOW

https://www.soteriatrusts.com/insights/estate-planning-why-begin-now/ #willing #willtowin If you’re wondering when the right time to start estate planning is, the answer is simple: it’s now. Our comprehensive guide will explain the importance of estate planning and why you should begin sooner rather than later. Have you thought about what will happen to your assets…

WHAT HAPPENS IF I DON’T PAY IHT?

https://www.soteriatrusts.com/insights/what-happens-if-dont-pay-iht/ #willing #knowyourwill The UK’s standard Inheritance Tax (IHT) rate is 40%. IHT must be paid by the executor on the net worth of the deceased person’s estate above the tax-free threshold of £325,000 per single person or £650,000 per couple. However, paying Inheritance tax is not always a straightforward…

WHY WRITING A WILL IS SO IMPORTANT – 10 COMMON MYTHS DEBUNKED

https://www.express.co.uk/finance/personalfinance/1510250/Writing-will-important-myths-evg #willing #knowyourwill WILLS are an essential legal document that cares for a person's wishes after they have died. Despite this, there are some common myths that suggest otherwise. Why is writing a will so important? Death isn't something that many of us want to think about, however writing a…

SUCCESSION PLANNING: HOW TO HAVE THE “TALK” WITH YOUR FAMILY ABOUT IT

https://www.soteriatrusts.com/insights/succession-planning-how-to-have-the-talk-with-your-family-about-it/ #willwriting #willtowin The topic of Succession Planning often requires some careful consideration and balance. Most people have ideas about what they want for the next generations but don’t see why they should plan ahead. Procrastination and the influence of opinions from others are the two biggest reasons used as…

HOW TO UPDATE YOUR ESTATE PLAN AFTER A DIVORCE

https://www.soteriatrusts.com/insights/estate-plan-divorce/ #knowyourwill #willwriting Life often throws us the unexpected, and they don’t come much bigger than the breakdown of a marital relationship. There’s no such thing as an easy divorce, even when things are reasonably amicable to start with. Once the lawyers get their teeth into it, things can get…

FIVE MYTH-BUSTING FACTS ABOUT WILLS

https://www.telegraph.co.uk/lifestyle/cancer-charity-gifts-in-wills/myths-about-wills/ #willwriting #knowyourwill Wills don’t have to be difficult or expensive, and can save money in the long run. David Prosser tackles common misconceptions about wills Why don’t more Britons make a will? Surveys published in recent years have consistently found that people in the UK aren’t making any formal provisions setting…

CONTESTING A WILL – EVERYTHING YOU NEED TO KNOW

https://www.soteriatrusts.com/insights/contesting-a-will-everything-you-need-to-know/ #knowyourwill #willtowin Contesting a will is the process of challenging the validity of someone’s last will and testament after they have died. It can be done by potential beneficiaries or heirs who believe that the contents of the will are not in line with their expectations or are not…

WHO INHERITS MONEY AND PROPERTY IF SOMEONE DIES WITHOUT A WILL?

https://www.equifax.co.uk/resources/money-management/what-happens-if-you-dont-leave-a-will.html #knowyourwill #willing When someone passes away with a legally-binding will, the process for the legal teams overseeing its execution is clear, with named parties on hand to make sure. When there is no will, then the deceased will be dying ‘intestate’. If this happens, the law decides who should…

LOCATING IMPORTANT DOCUMENTS WHEN SOMEONE DIES: HOW TO FIND A WILL

https://www.soteriatrusts.com/insights/how-to-find-will/ #willing #willwriting Locating the important documents of somebody who has just died is often a cause of additional stress and anxiety for family members. The first and most important of documents needed at this time is the Will, which specifies how the estate will be divided after the Testator’s…

DO I HAVE TO PAY INHERITANCE TAX ON MY PARENTS’ HOUSE?

https://www.soteriatrusts.com/insights/inheritance-tax-parents-house/ #knowyourwill #willwriting A short answer to the question “Do I have to pay inheritance tax on my parent’s property” is yes. You have to pay inheritance tax in the UK for your parent’s house, and families often question why they have to pay taxes on property and estate that…

WHO WILL INHERIT IF THERE IS NO WILL? – THE UK INTESTACY RULES

https://www.soteriatrusts.com/insights/uk-intestacy-rules/ #knowyourwill #willwriting When an individual passes away unexpectedly without a valid Will, their possessions and overall estate becomes subject to a set of rules known as the “rules of intestacy”. While these rules are set with logic to ensure the closest family members receive the bulk of the estate,…

WILL WRITING SERVICES PROS AND CONS

https://www.moneyhelper.org.uk/en/family-and-care/death-and-bereavement/will-writing-services-pros-and-cons #willing #willtowin The need to use a will writing service depends on the complexity of your will. It can be cheaper than a solicitor and more reliable than a DIY will. Take this FREE course and get a certificate and £50 Voucher. How will writing services work? Will writing…

LASTING POWERS OF ATTORNEY: WHAT THEY CAN DO FOR YOU

https://www.soteriatrusts.com/insights/why-lasting-powers-of-attorney/ #willing #willwriting It’s common knowledge that setting up an estate plan while you are alive allows your wishes to be easily followed after death. What isn’t commonly discussed, however, is how Lasting Powers of Attorney can provide peace of mind during your lifetime. These particularly important documents apply only…

MAKING A WILL

https://www.citizensadvice.org.uk/family/death-and-wills/wills/ #willing #willwriting This advice applies to England. It's good to learn, and it's FREE today - CLICK HERE Why it is important to make a will It is important for you to make a will whether or not you consider you have many possessions or much money. It is…

Calls for increased LPA awareness due to an expected rise in dementia numbers

According to Alzheimer’s Research UK, the number of people with dementia is on a rapid increase. Figures provided by the charity, predict that by 2025, one million people in the UK will be living with dementia and by 2050 this figure will be doubled. What is dementia? According to Dementia…

Funeral Costs are on the Rise

Bizarre bequests from beyond the grave.

A will is supposed to help surviving family and friends dispose of your estate after you've passed away. Many people use it as an opportunity to send a message from beyond the grave, either by punishing potential heirs with nothing or perhaps by giving away something fun or unusual to…